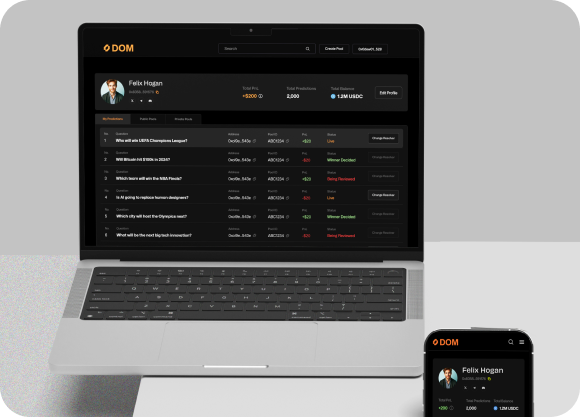

Decentralized options market is an automated, decentralized outcome market system enabling open participation in real-world prediction and incentive-based markets. With AMM-based architecture, dual-verification

oracles, and governance-driven evolution, it offers a scalable framework for turning knowledge into value—across finance, science, geopolitics, and beyond.

Core Modules

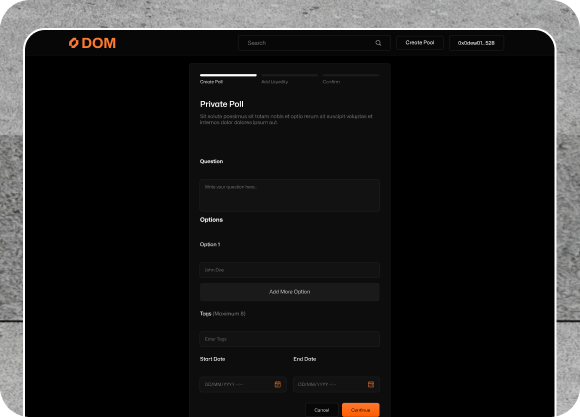

Automated Market Creation Engine

Anyone can launch a market using a pool-based system that dynamically adjusts pricing and liquidity based on demand. No coding, no centralized approval — just define the outcome and set it live.

Dual-Layer Oracle Verification

Markets are resolved via a two-stage oracle system. If outcomes go uncontested, they’re auto-resolved. If challenged, they escalate to a decentralized network of oracles for final judgment — ensuring trust, speed, and accuracy.

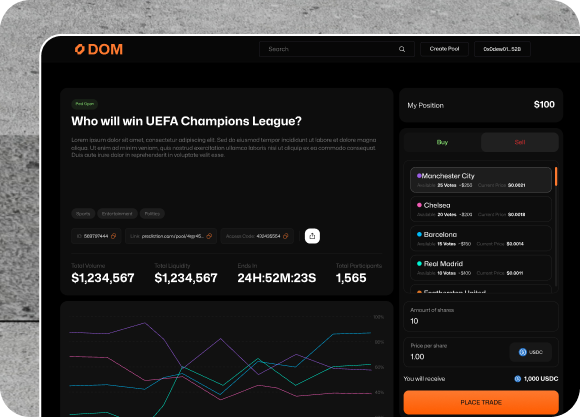

Dynamic Pool-Based AMM

Predictive Mesh’s innovative AMM model allows users to continuously mint outcome shares. Pricing reflects market sentiment in real-time. This enables efficient trading even in low-liquidity or long-tail markets.

Incentive Markets

Beyond predictions, Predictive Mesh allows anyone to offer bounties for specific outcomes — turning incentives into actionable goals. Communities and orgs can stake value behind objectives, effectively aligning effort with results.

Liquidity-Preserving Exit Mechanism

Predictive Mesh enables users to place exit orders without withdrawing liquidity. New participants are automatically matched with exiting sellers internally — maintaining capital efficiency while offering flexible position exits.

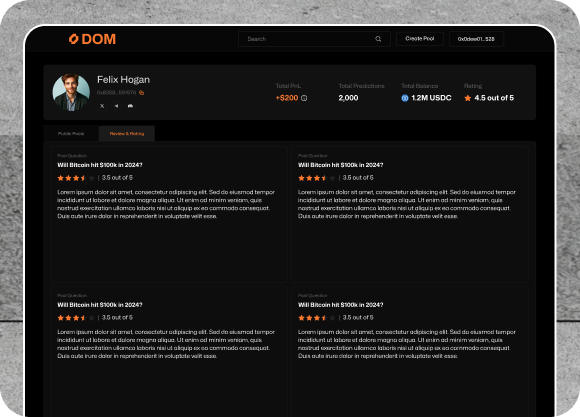

Governance & DAO Integration

Governance token holders shape protocol rules, market categories, and future upgrades. As a decentralized infrastructure, Predictive Mesh supports multiple front-ends and adapts through transparent DAO mechanisms.